While personal credit bureaus, such as Equifax, Experian, and TransUnion, collect and maintain information about individuals’ credit histories, business credit bureaus like Dun & Bradstreet, Experian Business, and Equifax Business gather data on businesses’ credit transactions, trade payments, and financial behaviors.

What are the 3 business credit bureaus?

As we mentioned above, Dun & Bradstreet, Experian Business, and Equifax Business are known as the “big three” business credit bureaus.

Experian and Equifax may sound familiar to you if you’ve ever checked your personal credit scores because they offer both personal and business credit reporting services, whereas Dun & Bradstreet focuses exclusively on business credit.

Dun & Bradstreet

According to the Dun & Bradstreet (D&B) website, “Dun & Bradstreet hosts business credit files on over 500 million global businesses subject to rigorous data governance standards and the deep collection of business attributes and behavioral signals Dun & Bradstreet has cultivated since the early 1800s.”1

D-U-N-S Number

To look up your company (or any company) in the D&B database, it must have a D-U-N-S Number, which stands for Data Universal Number System. D-U-N-S Numbers are not automatically given; instead, they must be requested by a verified business owner or officer.

There is no requirement for your company to have a D-U-N-S Number but getting one could still be a good idea – and it’s completely free! You never know when you might have the opportunity to do business with a company that requires it.

Dun & Bradstreet scores and ratings

D&B’s proprietary predictive scores and ratings are designed to help stakeholders understand a company’s creditworthiness. Here’s a look at some of the specific scores and ratings that may be included in a D&B business credit report:2

- Overall Business Risk

The Overall Business Risk is a high-level risk evaluation that assesses a company using the best available scores, ratings, and indices. The Overall Business Risk is scored on a five-point scale, from low to high risk, with additional statements describing the business’s current and future health.

- PAYDEX Score

The PAYDEX score is a concise dollar-weighted assessment of the business’s payment performance over the past two years. The score is based on trade experiences reported by vendors and is derived from a weighted average of a company’s combined individual payment experiences (larger invoice amounts weigh heavier in the overall index). It’s based on a scale of 1-100 (where 100=best and 0=worst). A score of 80 is the benchmark; it means that a company pays its bills on time, or promptly, according to its suppliers.

Note: A company needs at least three trade experiences reported by at least two different vendors in order to have a PAYDEX score.

- Delinquency Score

The D&B Delinquency Score, formerly the Commercial Credit Score, predicts the likelihood a company will pay its bills in a severely delinquent manner – 90 days past due or later. The Delinquency Score is displayed on a scale from 1 to 100. A score of 1 indicates the highest risk, while 100 indicates the lowest risk.

- Failure Score

The D&B Failure Score, formerly the Financial Stress Score, predicts the likelihood a company will cease operations, declare bankruptcy, or simply go out of business without paying its creditors. Like the Delinquency Score, the Failure Score is displayed on a scale from 1 to 100, where a 1 indicates the highest risk and 100 indicates the lowest risk.

- Maximum Credit Recommendation

Maximum Credit Recommendation suggests the greatest amount of credit that Dun & Bradstreet suggests extending, based on monthly payment terms. The amount is the total value of goods and services that the average creditor should have outstanding across multiple accounts and invoices — not necessarily the maximum amount it can afford. The recommendation is based on a historical analysis of similar companies in the Data Cloud.

For a more comprehensive explanation of Dun & Bradstreet’s scores and ratings, check out the Dun & Bradstreet Sample Credit Report.

Experian Business

Similarly to how Experian collects and generates credit reports for individuals, Experian Business does the same thing for businesses. Here’s a look at some of the specific scores and ratings that may be included in an Experian Business credit report:3

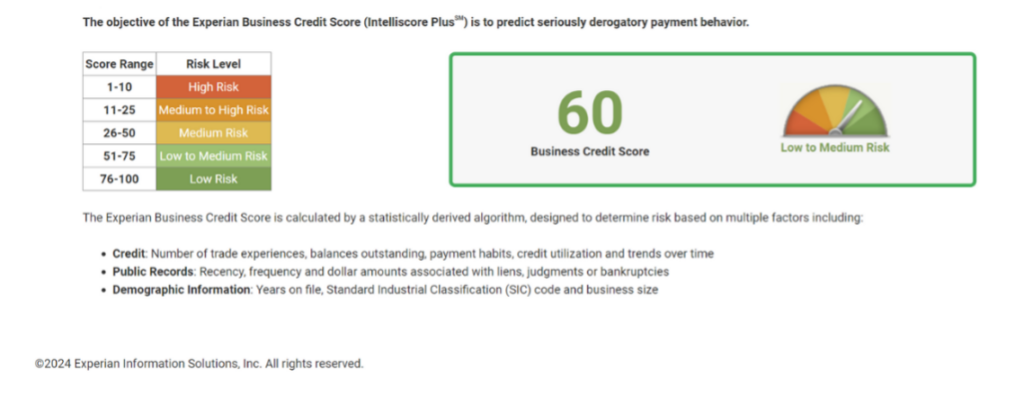

- Business Credit Score

The objective of the Experian Business Credit Score is to predict the likelihood of serious credit delinquencies within the next 12 months. Business Credit Scores range from a low of 1 to a high of 100, where higher scores indicate lower risk.

- Financial Stability Risk Rating

The Experian Financial Stability Risk Rating predicts the likelihood of severe financial distress (such as payment default and/or bankruptcy) within the next 12 months. This rating ranges from a low of 1 to a high of 5, where lower ratings indicate lower risk. It also uses tradeline and collections information, public filings as well as other variables to predict future risk.

For a more comprehensive explanation of Experian’s scores and ratings, check out the Experian Business Sample Credit Report.

Equifax Business

Equifax is another credit bureau that offers personal and business credit reporting. Here’s a look at some of the specific scores and ratings that may be included in an Equifax Business credit report:4

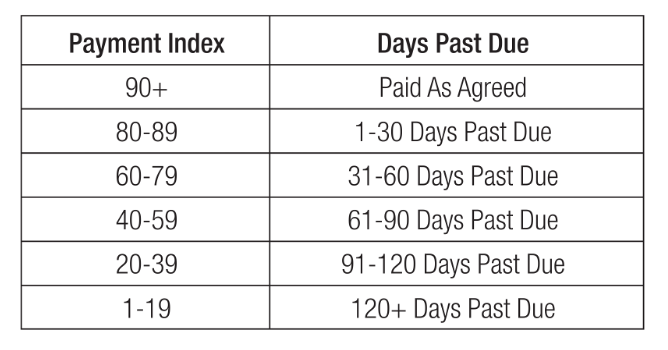

- Equifax Payment Index Score

The Equifax Payment Index Score is a dollar-weighted indicator of a business’s payment performance based on the most recently reported financial and non-financial payment experiences in the Equifax Commercial database. The chart below provides a suggested interpretation of the Payment Index value:

- Business Delinquency Score

The Equifax Business Delinquency Score predicts the likelihood of severe delinquency (91 days or greater), charge-off, or bankruptcy within the next 12 months. The score is built using both financial services and trade payment data, providing a higher degree of predictability. The score range is 101 – 662, with a lower score indicating higher risk. A “0” indicates a bankruptcy on file.

- Business Failure Score

The Business Failure Score predicts the likelihood of business failure through either formal or informal bankruptcy within the next 12 months. The score Range is 1000 – 1604, with 1000 indicating the highest risk of failure. A “0” here also indicates a bankruptcy on file.

For a more comprehensive explanation of Equifax’s scores and ratings, check out the Equifax Business Sample Credit Report.

Business credit reporting agencies

It’s important to remember that in addition to the “big three” credit bureaus, there are other business credit reporting agencies out there, some of which are specialty reporting agencies that focus on certain industries. You should do your research and ask any potential lenders where they pull business credit score profiles so you can focus on building a positive score where it matters.

How to check business credit score

You can check your business credit score by visiting the website of the chosen credit reporting agency and navigating to the section for business credit reports. There, you’ll typically find options to request a credit report or sign up for a subscription service that provides regular access to your business credit information.

Free business credit report

Unfortunately, business credit bureaus aren’t legally required to give you free copies of your business reports. While some offer limited reports for free, you may have to pay a fee or sign up for a subscription to regularly review your complete credit report.

The bottom line

By learning how the big three credit bureaus—Dun & Bradstreet, Experian Business, and Equifax Business—gather information, calculate scores, and update records, you can better navigate the credit reporting system.

Additionally, it’s important to understand that building and maintaining business credit requires a hands-on approach, involving consistent and proactive management of your financial activities. Regularly monitoring your credit reports, making timely payments, and managing your debt-to-income ratio are crucial steps in fostering a healthy business credit profile.