Navigating the tax landscape as an independent contractor can be confusing and complicated. Unlike traditional employees who see taxes neatly deducted from each paycheck, independent contractors are responsible for paying quarterly estimated tax payments and self-employment taxes and sorting through a myriad of deductions that can send someone screaming for the hills.

What is an independent contractor?

An independent contractor earns income from a service, trade, or business and is paid directly by customers or clients. Some examples include, but are not limited to:

- freelancers, such as artists, writers, graphic designers, and musicians

- nurses and other workers paid by the day or by per diem

- by-the-job professionals, such as temporary agency workers

- consultants, doctors, lawyers, and accountants

- IT professionals and software developers

- real estate agents

- building trade contractors, such as painters, plumbers, and electricians

- ride-sharing workers, such as Uber and Lyft drivers

- babysitters

- other independent professional workers

Do independent contractors pay taxes?

Yes, independent contractors are responsible for paying taxes on their income, just like everyone else. However, when you work as an independent contractor, you’re considered self-employed, which means you’re responsible for paying both income and self-employment taxes.

- Income Tax

Independent contractors need to report their income on their tax returns and pay federal and state income taxes on that income. They typically pay estimated taxes quarterly throughout the year, instead of having taxes withheld from each paycheck like traditional employees.

- Self-Employment Tax

This tax covers Social Security and Medicare taxes for self-employed individuals. Usually, employees and employers split these taxes, but when you’re self-employed, you’re responsible for paying the full amount, often referred to as the “self-employment tax.”

As mentioned above, independent contractors typically make estimated tax payments to the Internal Revenue Service (IRS) four times a year, aka quarterly. But why is this?

What are quarterly estimated tax payments?

The U.S. tax system operates on a “pay-as-you-go” basis, meaning taxpayers are generally expected to pay taxes on income as they earn it. For traditional employees, taxes are withheld from their paychecks by their employers and sent to the IRS on their behalf. However, independent contractors don’t have taxes withheld from their income, so they’re responsible for paying taxes on their earnings.

Paying taxes quarterly helps independent contractors meet the “pay-as-you-go” requirement and avoids a large lump sum payment at the end of the year. It also helps them avoid underpayment penalties. If an individual’s tax liability at the end of the year exceeds a certain amount (typically $1,000 for federal taxes) and they haven’t paid enough throughout the year, they may be subject to penalties for underpayment.

Who has to make quarterly estimated tax payments?

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed. Corporations generally have to make estimated tax payments if they expect to owe tax of $500 or more when their return is filed.

How do I make my quarterly tax payments?

There are a couple of different ways independent contractors can make quarterly tax payments.

You can use IRS Form 1040-ES and send estimated tax payments by mail, online, by phone, or from your mobile device using the IRS2Go app; or, you can use the Electronic Federal Tax Payment System (EFTPS).

EFTPS is an easy way for individuals and businesses to pay federal taxes. Using EFTPS, you can access a history of your payments so you know how much and when you made your estimated tax payments. For additional information, refer to Publication 505, Tax Withholding and Estimated Tax.

What if quarterly tax payments are late?

If you don’t pay enough tax by the due date or if your payment is late, you may be charged a penalty even if you are due a refund when you file your income tax return. Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits or if they paid at least 90% of the tax for the current year or 100% of the tax shown on the return for the prior year, whichever is smaller.

How much is the penalty for not paying estimated taxes?

The penalty is 0.5% of the amount unpaid for each month or part of the month that the tax isn’t paid. The amount you owe and how long it takes to pay the penalty impacts the total penalty amount.

If you want to avoid these penalties, make sure you pay estimated quarterly taxes on time and avoid underpayment.

When are taxes due for independent contractors?

Unlike traditional employees who only worry about April 18, The Tax Day, independent contractors have five major dates when taxes are due throughout the year.

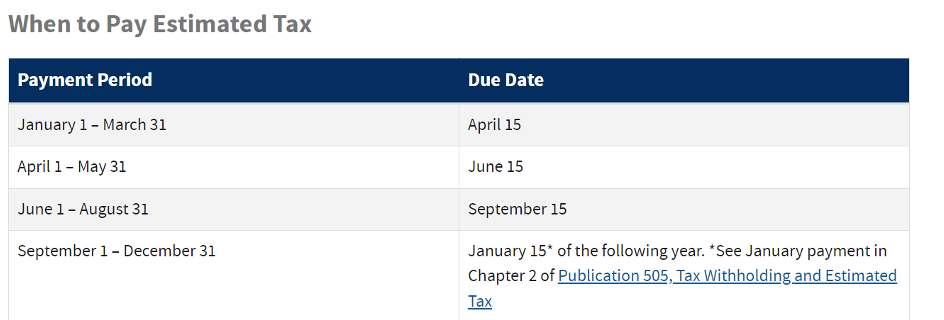

Quarterly tax payments are usually made to the IRS four times a year—on April 15, June 15, September 15, and January 15 of the following year. For example, for income earned between January 1 and March 31, the quarterly tax payment is due on April 15.

Note: If the due date for making an estimated tax payment falls on a Saturday, Sunday, or legal holiday, the payment will be on time if you make it on the next day that’s not a Saturday, Sunday, or legal holiday. 1

However, in addition to these four quarterly tax payments during the year, independent contractors still have to file their annual returns like everyone else to reconcile tax payments for the previous year.

Keeping track of these deadlines and setting reminders can help ensure timely payments. Additionally, estimating taxes accurately is important to avoid overpaying or underpaying throughout the year. Consulting with a tax professional can provide guidance on estimating and managing quarterly tax payments.

How much should independent contractors save for taxes?

The amount an independent contractor should save for taxes can vary based on several factors, such as income, business expenses, deductions, and the specific tax laws in their state. As a general rule of thumb, many independent contractors set aside around 25% to 40% of their income for taxes.

However, consulting with a tax professional or accountant for personalized advice is crucial. They can help you determine the exact percentage you should save based on your income, expenses, deductions, and any potential tax credits available to you.

Setting aside a portion of your income regularly in a separate account designated for taxes can help ensure you have the funds available when tax time comes around. Keeping accurate records of your income and expenses throughout the year can also make tax preparation smoother and reduce your tax liability through allowable deductions.

Can I pay my taxes when I file my annual return?

Independent contractors can choose to pay taxes in one lump sum when they file their annual return; however, you may need to be prepared to pay potential penalties if you have not paid enough throughout the year.

Remember, the U.S. tax system operates on a “pay-as-you-go” basis, and quarterly estimated tax payments allow independent contractors to spread their tax obligations over the year, making it more manageable and reducing the risk of penalties for underpayment.

Do 1099 employees pay more taxes?

Generally – yes. If you worked full-time for an employer, then your employer would be responsible for paying a portion of your Social Security and Medicare taxes. In the absence of said employer, you are on the hook for these taxes, which are more commonly known as “self-employment tax.”

State individual income tax for independent contractors

Don’t forget that if your state has income taxes, you’ll also need to make estimated tax payments to your state. Currently, forty-three states and the District of Columbia levy individual income taxes, while seven states levy no individual income tax at all.2

Some states include tax brackets, exemptions, and deductions for inflation; many others do not. Some states tie their standard deductions and personal exemptions to the federal tax code, while others set their own or offer none at all. That’s why it’s important to check with your state’s business resources for deadlines and any required forms.

Taxes for independent contractors

Understanding taxes for independent contractors is crucial to effectively managing your finances, accurately reporting income, maximizing deductions, and fulfilling their tax obligations. Consulting with a tax professional can provide further guidance tailored to your situation.

Sources: